Will Prep Forms

To request the preparation of your client's Will by our Team, we'll need you to complete some preparatory forms. These forms will assist the Will Prep Team in gathering the necessary information. To navigate to the prep forms click here

You can download the form as a PDF and fill out the Clients information.

National (ALL Provinces/Territories)

Step 1.

To start, let's enter some information on you clients, such as their name, address, martial status, and spouse.

Note: If divorced / widowed, please select Single for Last Will and Testament purpose.

Step 2.

If the client has any children, you’ll need to enter their full legal name.

You will also need to indicate if the child is a dependent.

Step 3.

If their children are minors or are considered a dependent, you can appoint someone as their Guardian, who would take care of their children in the event that their spouse doesn’t survive them, or in the event that they have no spouse.

Step 4.

In the next section, we’ll specify who will receive the residue of the estate, once all expenses are settled and all gifts are distributed. This person can be the client’s spouse, or a group of specified individuals.

Step 5.

If it’s the latter, enter the full legal name of each Beneficiary, as well as the city or town they live in, and the number of shares they should receive.

Note: An ALTERNATE BENEFICIARY is named in the event, the Designated Beneficiary#fI predeceases you, in which case, the Residue of Estate will go to the Alternative Beneficiary.

If TWO OR MORE named Beneficiaries, there is no option for an Alternate Beneficiary. You will be provided an option to allocate 100 Shares of the Residue of Estate (excluding Gifts) to the Designated Beneficiaries/ Charitable Organizations. However, the total for all recipients MUST add up to 100 Shares.

Note: The Charity/ Organization registration number is the official reference number issued by the government to every Charity/ Organization. The 15-digit number includes "RR" (e.g. 156846352RR1234) and is found on donation receipts. It is also commonly listed in the footer on the charity's website or reference the Government of Canada's Charity Search function.

Step 6.

Wipeout Clause: A wipeout beneficiary is a person or charity/ organization who will receive the estate IF YOUR SPOUSE, CHILDREN, GRANDCHILDREN, and/or Designated Beneficiaries (Item# 5) pass away. There can be more than one wipeout beneficiary. You will select Yes or No.

A Wipeout Clause would prevent the government from deciding how to distribute your estate should all named beneficiaries and their alternates predecease you.

Step 7.

Next is Wipeout Distribution. You will select Yes or No.

If you select No, you will need to fill out the information below.

Note:The Charity/ Organization registration number is the official reference number issued by the government to every Charity/ Organization. The 15-digit number includes "RR" (e.g. 156846352RR1234) and is found on donation receipts. It is also commonly listed in the footer on the charity's website or reference the Government of Canada's Charity Search function.

Step 8.

If the client wishes to leave any specific gifts to an individual or a charity, you can specify that here.

Note: You have the option to list an alternate beneficiary for each gift. However, your alternate recipient will only receive the gift if your first-choice refuses or passes away before you.

Note: The Charity/ Organization registration number is the official reference number issued by the government to every Charity/ Organization. The 15-digit number includes "RR" (e.g. 156846352RR1234) and is found on donation receipts. It is also commonly listed in the footer on the charity's website or reference the Government of Canada's Charity Search function.

Step 8.

Next you will fill out Inheritance Delay

Step 9.

Executor/ Personal Representative Details are who will oversee administering the estate.

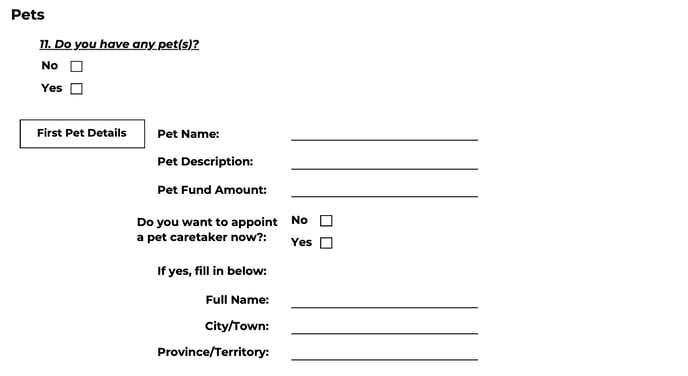

Step 10.

Next, you if you want a Backup Executor you will fill in the following information.

Note: If TWO Backup Executors are named, they must work JOINTLY

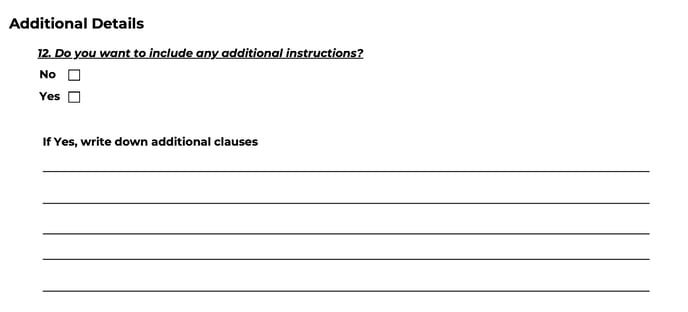

Note: Additional Details should NOT be used to change/ address other sections of the Will covered to this point. Details provided here will be added verbatim to your Last Will & Testament.

The goal is to avoid ambiguity. Use complete sentences and avoid abbreviations. Avoid using personal names and pronouns (we, us, you, they) and instead use the "Executor" or the "Guardian". Try to limit each clause to one paragraph.

Finally, Funeral Instructions should NOT be included in this document.